Corporate Development Spotlight

The Corporate Development Spotlight series is a newsletter highlighting corporate development and corporate M&A professionals. The series features spotlight interviews with top corporate M&A professionals and links to valuable resources, content and events.

To subscribe, participate in a spotlight interview, share content/events/resources for CorpDev Corner, please contact Aaron Polack at apolack@lionequity.com.

Ahsan Mukhtar

VP Finance, Corporate Development and Treasury

My career spans over 17 years in various leadership roles in the oil and gas industry. Some of the roles I have held in the past include leading global FP&A responsibilities and as a business unit controller for a division while at National Oilwell Varco (NYSE: NOV). Currently, at DistributionNOW (NYSE: DNOW), I lead the M&A strategy, treasury, global credit and collections, and shared services and data analytics. I am also on the Board of a not-for-profit organization that focuses on the local Houston refugee community, which allows me to make a meaningful impact by empowering new Americans with the necessary tools to be successful and thrive in our community.

DistributionNow

Company Website: www.dnow.com

Annual Revenues: >$1.6 Billion (2021)

Headquarters: Houston, TX

Current acquisition criteria: We are currently seeking targets that have a track record of strong historical earnings and cash flow generation, in particular, during the difficult pandemic years. These could be non-commoditized solutions looking to penetrate their technology/product offering into the oil and gas upstream end-markets or have a unique offering in the oil and gas midstream/downstream or industrial (e.g., mining, wastewater, renewable) space that provides greater market differentiation.

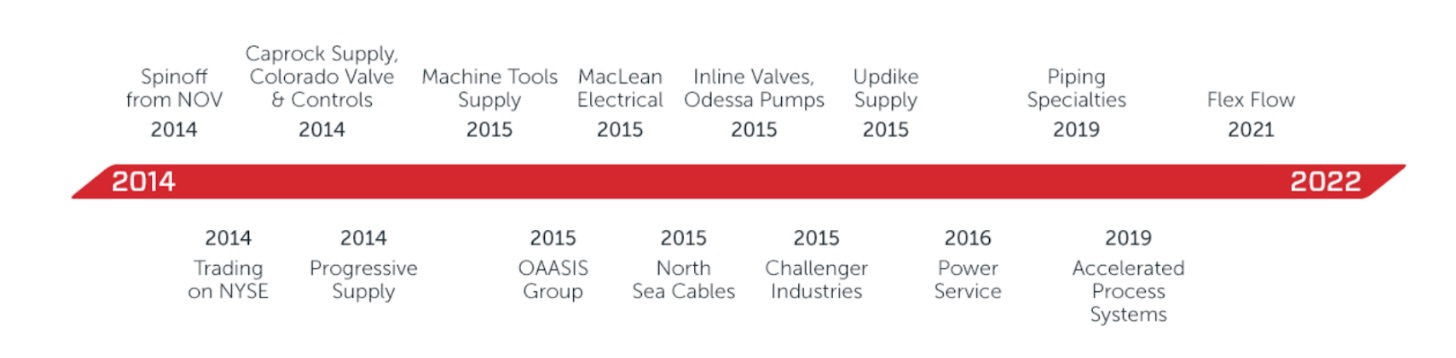

Recent M&A :

Spotlight Q&A:

Ahsan – Thanks for joining us for this issue of Corporate Development Spotlight! Can you provide a quick flyover of DistributionNow, your corporate development team and the approach to M&A?

Thank you for having me on your Corporate Development Spotlight! DistributionNOW, or also known as DNOW, is one of the largest distributors in the energy industry. As part of the global energy community, we are a critical link between manufacturers and customers through our leading supply chain technologies. Our customers include drilling contractors, service companies, oil and gas operators, midstream providers, downstream refineries, chemical plants, and industrial manufacturers.

Our 2021 revenue was $1.6B. We operate in 175 locations in 20 countries, delivering products into 80 countries. While we are extremely disciplined with how we manage our capital and take pride in our debt-free balance sheet today, we have every intent to use our cash wisely through M&A for accretive margin businesses that fit within our strategy and deliver strong shareholder returns.

We are a lean team with a handful of members, who in addition to working on M&A opportunities, play a broader role in DNOW’s financial organization, supporting global treasury strategy, global credit and collections, FX, data analytics, and other tasks to support our executive leadership. We generate prospects through our own internal research and connections in the industry, internal leads from our sales and operations channels, along with inbound interest from several respectable investment bankers and advisors, like Lion Equity Partners.

How have recent global supply chain issues affected your business and/or your current approach to M&A?

At this time, the supply chain issues have not changed our approach with respect to M&A. However, like other businesses, our industry has been coping with product inflation, material availability caused by shortages, and delays in the supply chain. Of our three reporting segments, our international segment experienced the most impact associated from delays in the supply chain and COVID related restrictions from manufacturers.

As I mentioned earlier, DNOW is a market leader providing supply chain solutions to the energy space, and we have an all-star global supply chain team deploying a multi-pronged approach to ensure products are available for our customers, and the cost increases that are incurred due to inflation are controlled as much as possible.

In addition, we leverage our global spend with suppliers to secure preferred access to product shipment allocations, provide domestic and import options for the same products, and find suitable product substitute for customers who increasingly depend on DNOW to run their operations.

What’s the biggest challenge you face as a Corporate Development professional?

Perhaps one of the biggest challenges for my team is just not being aware of businesses that are on the market for sale that are slightly outside of our current core offering. This is true particularly with respect to renewable and technology companies, who are quick to box us as a pure-play oil and gas service company. We believe that the right partner will be able to meaningfully expand their solutions to an untapped market through our footprint and extensive customer base.

The other challenge we face is more inward looking – capturing best practices to extract knowledge, understand our customer’s challenges and evaluate our value proposition gaps from within the trenches of the organization. While vision and strategy are set at the top, the direct and continuous feedback from our customer facing employees, such as inside sales, is immensely valuable as our strategy evolves. The more feedback we receive, the better our ability to narrow down our field of prospective targets, and the quicker we can learn and engage to get a deal to the finish line.

What is the most rewarding aspect of your career in Corporate Development?

I have been in Corporate Development for nearly four years, and perhaps the most rewarding aspect of this role is getting to meet extremely smart individuals, whether they are successful business owners or connections I make with leadership from private equity and investment firms, investment bankers and other advisors in the industry.

Additionally, there is no better joy in my career when playing a critical role in making a meaningful and positive impact to the future of our company and our employees, especially deals that outperformed our expectations, excite our employees, bring shareholder value, and propel the company in a new direction.

Predictions for the next 12 months in corporate M&A:

It’s hard not to talk about the next 12 months without discussing the Ukraine war. Just when we were looking forward to some sense of normalcy as COVID cases declined, the Ukraine war has added some volatility to the equity and commodity markets. The energy space, particularly oil and gas companies, are no stranger to volatility and have learned to navigate through the many downturns the industry has experienced during the last few decades.

One of the by-products of the war is that oil prices are at highs not seen since 2008, which has magnified the tight energy supply chain that exists today and has created renewed interest in the energy sector including M&A opportunities. Even prior to the Ukraine war, oil prices were in the eighties as the markets acknowledged the demand and supply imbalance in light of pent up demand for travel and other products and services. For these reasons, I am bullish for our sector and expect continued M&A activity in the oil and gas space. In addition, there is significant momentum for energy companies to make strides towards investments in renewable energy as the industry determines how to best strike a balance between the near-term energy supply needs and help bring relief to the pump, and support their long-term publicly disclosed ESG commitments.

Stepping away from the energy space, I do believe renewed optimism with the decline in COVID cases, higher personal savings, and opening up of global economies will create additional M&A opportunities across various sectors, despite the threat of the BA.2 variant and the recent uptick in cases in China. In addition, coupled with supportive debt markets, private equity still has plenty of ample dry powder to put funds to use.

The obvious headwind to all this optimism is inflation, specifically, the aggressive projected interest rate hikes by Fed Chairman Powell. We have been accustomed to cheap debt for some time now, but rising interest rates and rising cost of capital may impact valuation and curb M&A activity as multiples fall short of sellers’ expectations.

Lessons learned during your time in Corporate Development?

As most Corporate Development professionals can attest, your negotiation skills are put to a test when working on a deal. Though not a competitive sport, negotiations sure seem to feel like one! While there are plenty of books on how to negotiate, my advice to Corporate Development professionals is to always be aware of key aspects of what makes this deal exciting, and to not get tied up in small provisions that you can’t see the forest for the trees… unfortunately, at times, I am guilty of this.

Yes, our job requires us to be thorough in our due diligence and identify pitfalls, but I have yet to find a deal that checks all the boxes. As long as the core tenets of the deal are in line with your principles, solidifies the vision and is the catalyst to leap your company to greater earnings in the future, then a way must be found to mitigate some of those pitfalls.

My parting advice for Corporate Development professionals is to encourage them to add bolt-on roles in the field of business transformation, operational analysis and other financial roles, such as treasury and risk assessment. Corporate Development leaders are uniquely positioned in the company to become seasoned future C-suite leaders, especially roles that mix strategic operations and finance. I personally do my best to move my team around and expose them to different facets of the organization to aid in their career growth and keep them excited and passionate about the mission, and eventually, become successful leaders at DNOW.

Thank you for the opportunity to be part of your Corporate Development Spotlight.

CorpDev Corner – Resources for Corporate M&A Professionals

Article : 2022 Top Corporate Development Professionals to Watch

About: Middle Market Growth’s 2022 Business Development Report features a list of “Corporate Development Professionals to Watch.” The list was compiled by Middle Market Growth editors based on suggestions from members of the ACG dealmaking community, who were asked to nominate professionals who are actively pursuing acquisitions or divestitures on behalf of their organizations, who are well-respected by deal partners and peers, and who have achieved success in their roles.

Link to the article: Top Corporate Development Professionals to Watch

Event : M&A Academy at the University of Chicago (June 21 & 22)

About: The M&A Academy is designed to help corporate acquirers understand the breadth of strategic and practical considerations associated with acquisitions.

Link to the event page: M&A Academy at the University of Chicago

Companies Seeking Corporate M&A Talent

- AmeriVet – Corporate Development Analyst

- Agilent Technologies – Associate Vice President, Corporate Development

- Molina Healthcare – Corporate Development Manager

- IDEXX – Manager of Corporate Development

- Smartsheet – Executive Assistant, Corporate Development

- Zillow Group – Corporate Development Director

- ViacomCBS – Manager, Corporate Development

- Akamai – Senior Manager, Corporate Development

- Brillio – Corporate Development – M&A Deal Lead

- Circle – Corporate Development Principal

- Blue Cross Blue Shield – Manager of Corporate Development

- Datadog – Director, Corporate Development

- Seagate Technology – Analyst, Corporate Development

- Mastercard – Director, Corporate Development

- Meta – Corporate Development Manager

- iRobot – Corporate Development Manager

- USAA – Corporate Development Director

- Cadence Design Systems – Senior Manager, Corporate Development

- Splunk – Corporate Development Director

- Eastman – Manager, Corporate Development

- PlayStation – Director, Corporate Development

- IQVIA – Senior Director, Corporate Development

- Realtor.com – Director, Corporate Development

- Kimberly Clark – Sr. Manager, Corporate Development

- Sempra – Senior Corporate Development Advisor

- LinkedIn – Senior Manager, Corporate Development

- Ford Motor Company – Corporate Development Manager

- Ginko Bioworks – Manager, Corporate Development

- Workday – Manager, Corporate Development

- ADM – Director, Corporate Development

- Expedia Group – VP of Corporate Development & Strategy

- Visa – Corporate Development Senior Manager

- Duolingo – Lead, Corporate Development

- Wheel – Corporate Development Manager

- Blue Origin – Corporate Development Senior Manager

- Sodexo – Senior Manager II, M&A

- Navistar – Corporate Development Sr.

- Amazon – Sr. Finance Manager, Corporate Development

- Bridgestone Americas – Corporate Development Manager

- Vista Outdoors – Analyst, Corporate Development

- PayPal – Corporate Development Senior Associate

- Cargill – Corporate Development Sr. Analyst

About Lion Equity Partners:

Lion Equity is a Denver-based private equity firm founded with the core purpose of helping companies meet strategic divestiture objectives. The Partners of Lion Equity have significant experience acquiring corporate divestitures and the overall M&A process.

Why do corporations divest non-core divisions to Lion Equity:

- Proven track record of executing complex carve-outs from sellers, including Bed Bath & Beyond, Siemens, Pitney Bowes, Sodexo, The Washington Post and others;

- Demonstrated ability to execute time-sensitive carve-outs requiring speed and certainty of closure;

- Committed to flexible structures that meet seller’s divestiture objectives;

- Dedicated to seamless transition through a unique understanding of the specific issues involved both during due diligence and post-closing working with Seller, employees, customers and suppliers.

To discuss a corporate carve-out transaction, please contact:

Aaron Polack, Head of Business Development

w 303.847.4428 | c 720.675.9180

apolack@lionequity.com | LinkedIn

John Ciancio, Business Development Associate

w 720.420.4375 | c 847.899.2315

jciancio@lionequity.com | LinkedIn